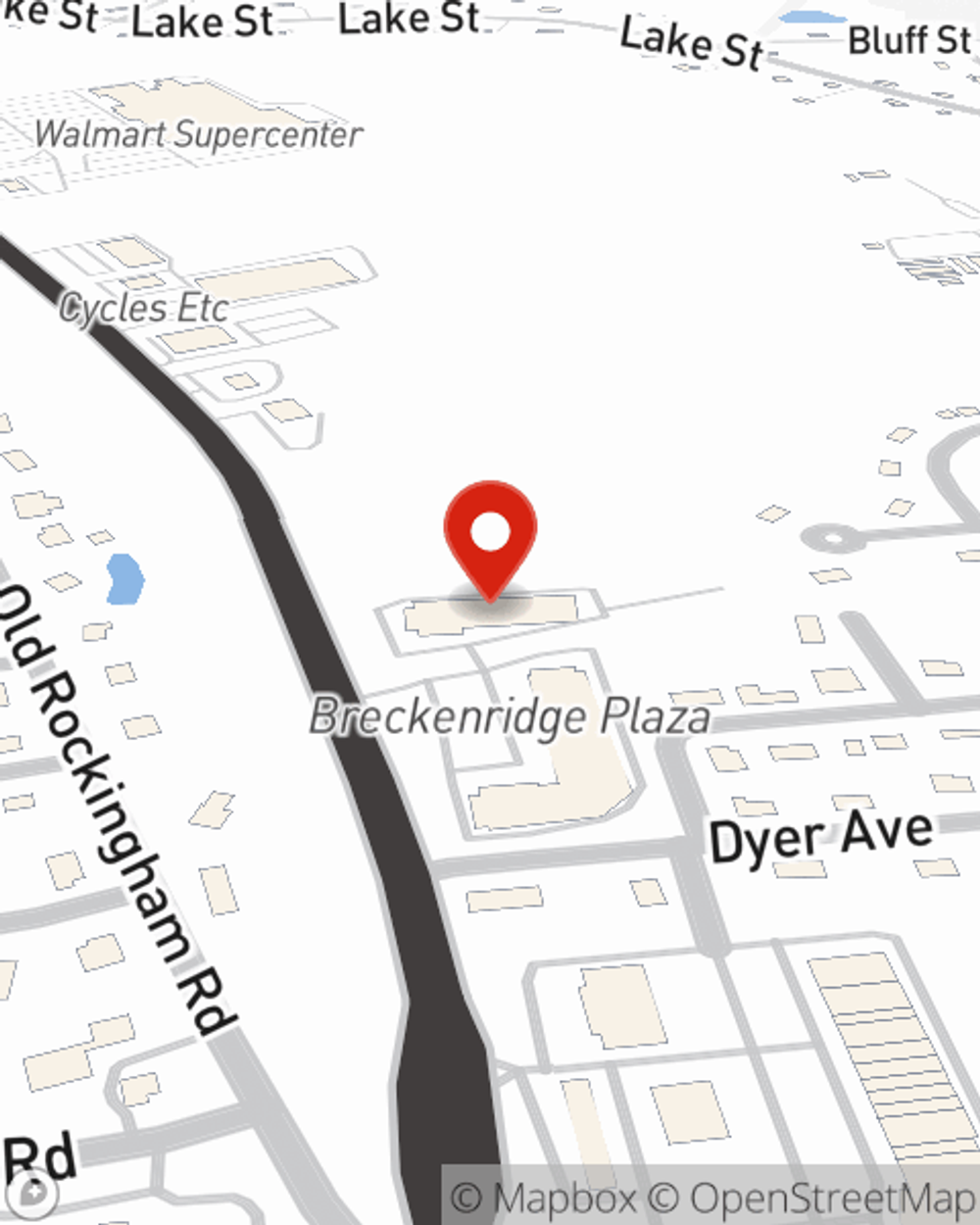

Renters Insurance in and around Salem

Get renters insurance in Salem

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Windham

- Derry

- Hampstead

- Londonderry

- Hudson

- Atkinson

- Plaistow

- Auburn

- Pelham

- Salem

- Rockingham County

- Hillsborough County

- Chester

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - furnishings, location, parking options, condo or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Salem

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

The unpredictable happens. Unfortunately, the personal belongings in your rented property, such as a cooking set, a video game system and a microwave, aren't immune to vandalism or break-in. Your good neighbor, agent Ed Ibanez, is ready to help you choose the right policy and find the right insurance options to help keep your things protected.

It's never a bad idea to be prepared. Visit State Farm agent Ed Ibanez for help learning more about savings options for your rented property.

Have More Questions About Renters Insurance?

Call Ed at (603) 212-7034 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.