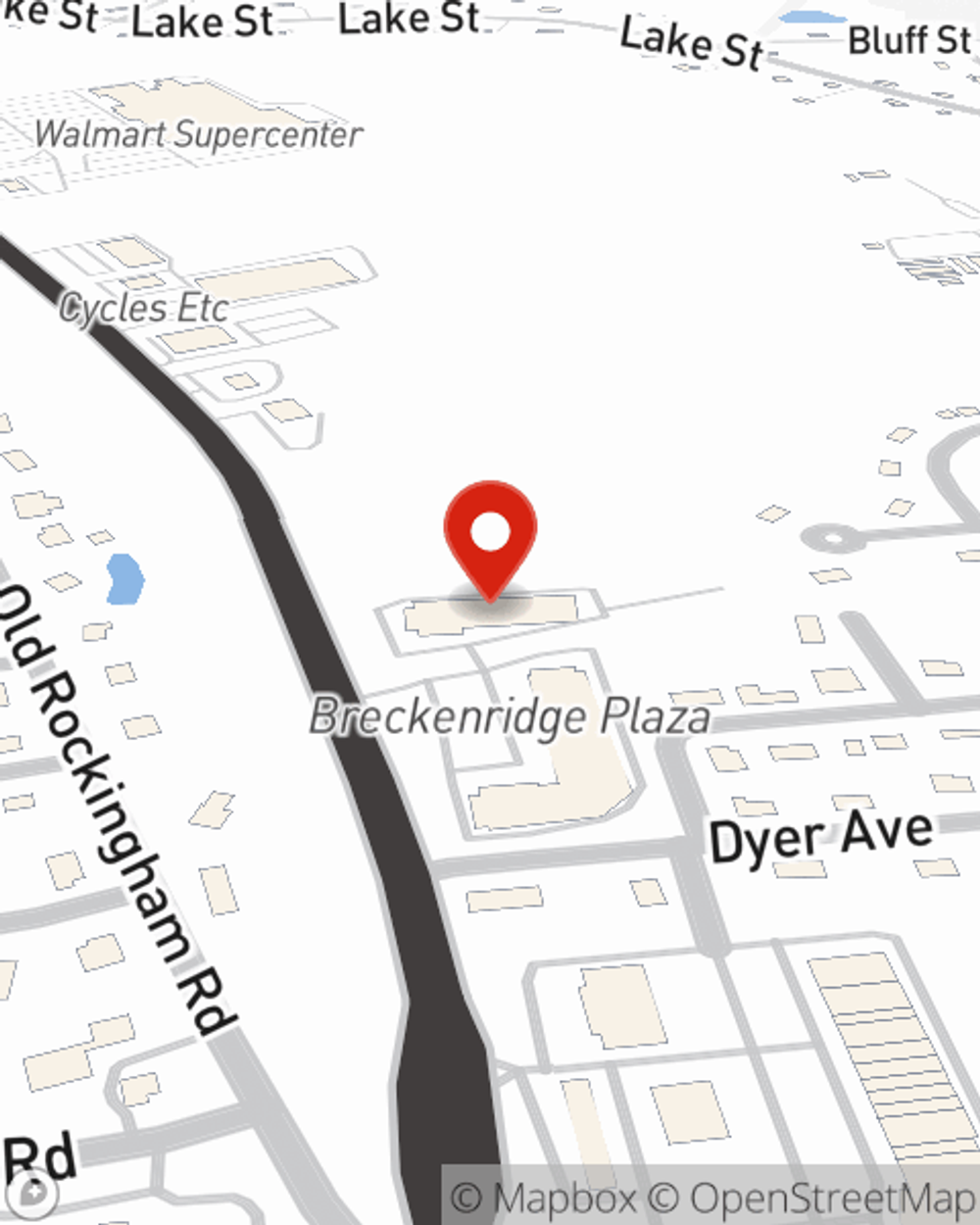

Business Insurance in and around Salem

One of Salem’s top choices for small business insurance.

Insure your business, intentionally

- Windham

- Derry

- Hampstead

- Londonderry

- Hudson

- Atkinson

- Plaistow

- Auburn

- Pelham

- Salem

- Rockingham County

- Hillsborough County

- Chester

Your Search For Great Small Business Insurance Ends Now.

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent Ed Ibanez, a fellow business owner, understands the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of Salem’s top choices for small business insurance.

Insure your business, intentionally

Customizable Coverage For Your Business

Whether you are a painter a surveyor, or you own a dry cleaner, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Ed Ibanez can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and accounts receivable.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Ed Ibanez's team today to explore the options that may be right for you.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Ed Ibanez

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.